Background Verification

Your Vision, Our Expertise: Background Verification Delivers

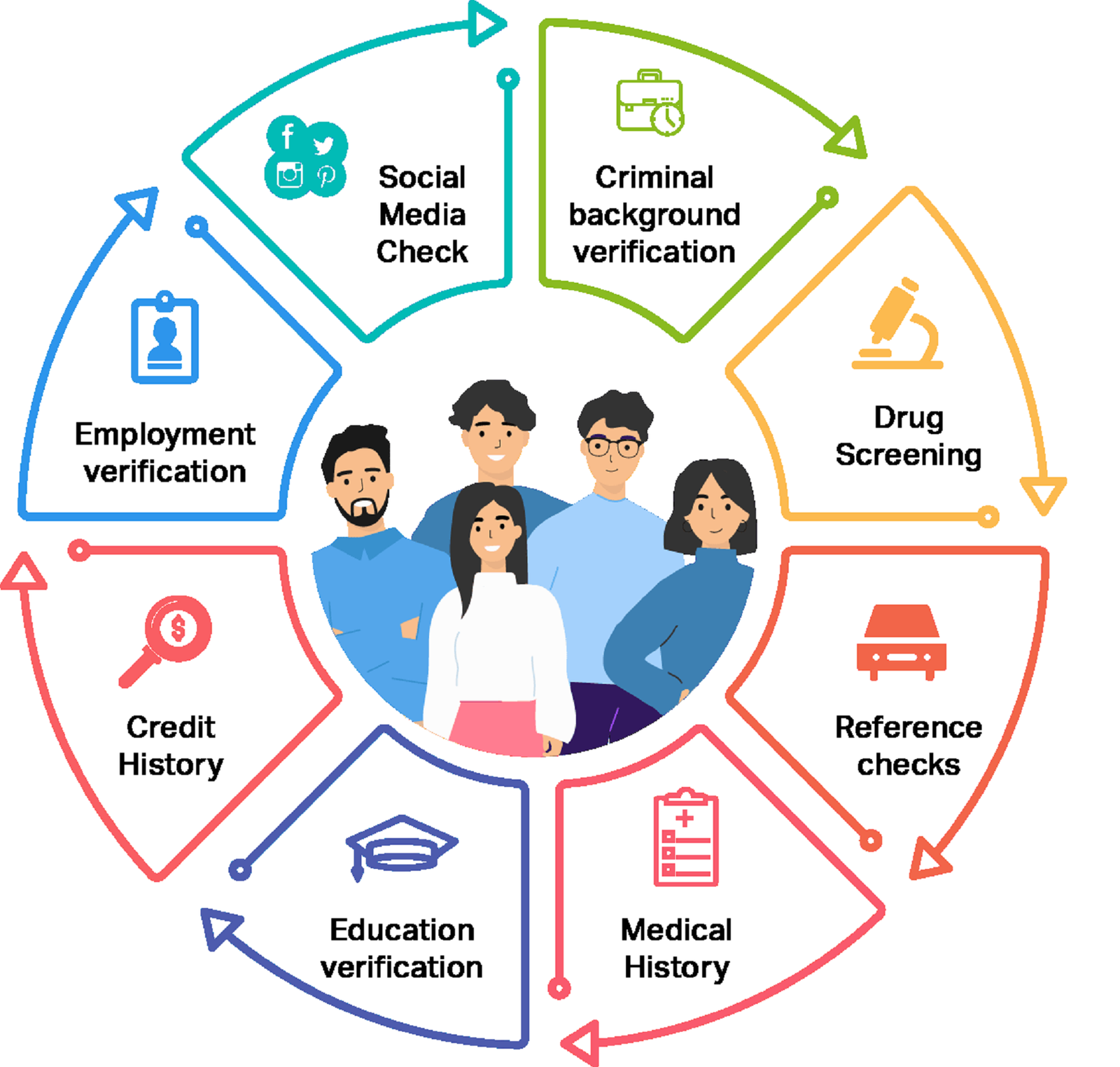

Background verification, also known as background check or screening, is the process of investigating and verifying an individual's personal, professional, educational, and sometimes criminal history. This process is commonly conducted by employers, landlords, financial institutions, and other entities to assess the credibility, reliability, and suitability of an individual for a specific purpose. Background verification can include various components depending on the context, and it aims to provide a comprehensive overview of an individual's background. Background verification helps organizations and individuals make informed decisions, mitigate risks, and maintain a level of trust and safety in various contexts, such as employment, housing, and financial transactions. It is important to note that the specific components and depth of background verification may vary based on legal regulations, industry standards, and the specific requirements of the entity conducting the check.

White-collar background verification refers to the process of conducting a thorough background check on individuals who are typically employed in professional, managerial, or administrative positions, often in office settings. This type of background verification focuses on assessing the professional and educational qualifications, employment history, and other relevant information of individuals working in "white-collar" professions, which are typically non-manual and office-based. White-collar background verification is often conducted by employers, human resources departments, or third-party background screening agencies. It is a standard practice to ensure the accuracy of information provided by candidates during the hiring process and to make informed decisions about the suitability of individuals for positions that involve trust, responsibility, and professionalism. The level of background verification may vary based on industry regulations, company policies, and the specific requirements of the position. Key components of white-collar background verification may include:

Blue-collar background verification involves conducting checks on individuals employed in manual, skilled, or labor-intensive occupations. Unlike white-collar workers who typically engage in professional, managerial, or administrative roles, blue-collar workers are often involved in jobs that require physical labor, technical skills, and hands-on work. Blue-collar background verification focuses on assessing the individual's suitability for roles in industries such as construction, manufacturing, transportation, maintenance, and other similar fields. Blue-collar background verification is commonly conducted by employers, staffing agencies, or third-party background screening firms to ensure that individuals have the necessary skills, qualifications, and attributes for roles in industries that involve manual labor. It helps employers make informed hiring decisions, promote workplace safety, and comply with industry regulations. The specific components of background verification may vary based on the industry, the nature of the job, and the legal requirements applicable to the hiring process. Key components of blue-collar background verification may include.

Managed Services

You can trust that your organization's integrity and security are in capable hands. Let us handle the complexities of background checks while you focus on driving your business forward. Contact us today to learn more about how we can support your hiring process and safeguard your organization's success.Self Services

Take control of your background verification process.Our flexible, cost-effective solution empowers you to conduct thorough checks with ease and confidence. Say goodbye to outsourcing – streamline your verification process today with our intuitive platform and API integration-

Aadhar Verification

-

Pan Card Verification

-

Voter Id Verification

-

Driving License Verification

-

Passport Verification

-

Physical Address Verification

-

Digital Address Verification

-

Education Verification

-

Employment Verification

-

Reference Check

-

Police Verification

-

Court Records Verification

-

Global database Verification

-

Credit Check

-

Drug Test Screening

-

Tenant Verification

Aadhar Verification

What it is: Aadhaar verification refers to the process of authenticating the identity of an individual using their Aadhaar number, which is a unique 12-digit identification number issued by the Unique Identification Authority of India (UIDAI).

Why it should be done: Aadhaar verification is conducted for several reasons, primarily aimed at enhancing security, preventing identity fraud, and streamlining government services. Here are some key reasons why Aadhaar verification is done

Digital Address Verification

What it is: Digital address verification refers to the process of confirming the accuracy and validity of a person's or business's digital address, which may include email addresses, physical addresses, or other online contact information. This verification is essential for various reasons in the digital age.

Why it should be done: Digital address verification is essential for maintaining accuracy, preventing fraud, ensuring effective communication, and complying with legal requirements in the digital realm. It is a critical component of various online processes and services, contributing to the efficiency and reliability of digital interactions.

Employment Verification

What it is: Employment verification is the process of confirming the accuracy and authenticity of an individual's employment history and details with their current or former employers.

Why it should be done: Employment verification is a crucial step in the hiring process to ensure that employers make informed decisions, hire qualified and trustworthy individuals, and maintain the integrity of their workforce. It helps protect organizations from potential risks and liabilities associated with hiring decisions.

Education Verification

What it is: Education verification is the process of confirming the educational qualifications and credentials of an individual. This verification is often conducted by employers, educational institutions, or background screening agencies to ensure that the information provided by an individual regarding their educational background is accurate.

Why it should be done: Education verification is essential for maintaining the integrity of the hiring process, ensuring that individuals possess the required qualifications for their positions, and preventing misrepresentation of educational credentials. It plays a crucial role in building trust between employers and employees while upholding standards and compliance in various industries.

Court Record Verification

What it is: Court record verification involves the process of checking and validating an individual's legal history, including any criminal or civil cases they may have been involved in. This verification is commonly conducted by employers, landlords, legal professionals, and other entities for various reasons.

Why it should be done: Court record verification is a valuable tool for assessing an individual's legal history and background. It is conducted for various purposes, including employment, housing, legal proceedings, and personal relationships, to make informed decisions and mitigate potential risks.

Reference Check

What it is: A reference check is a process in which an employer contacts individuals who have previously worked with a job candidate, typically former employers, supervisors, or colleagues, to gather information about the candidate's work history, performance, and qualifications

Why it should be done: Reference checks are a crucial step in the hiring process that helps employers gather comprehensive information about a candidate's background, work history, and qualifications. This process contributes to making well-informed hiring decisions and ensuring that the selected candidate is the right fit for the organization.

Global Database Verification

What it is: Global Database Verification typically refers to the process of verifying the accuracy, completeness, and consistency of a database that contains information on a global scale. This could involve verifying various types of data, such as customer information, employee records, financial data, or any other dataset with a global reach.

Why it should be done: Global database verification is critical for organizations to maintain trustworthy, compliant, and efficient databases, supporting various aspects of their operations, risk management, and decision-making processes. It plays a key role in building trust, ensuring compliance with regulations, and minimizing the potential risks associated with inaccurate or outdated data.

Credit Checks

What it is: A credit check is the process of evaluating an individual's creditworthiness by examining their credit history and financial behavior. It is often conducted by financial institutions, lenders, landlords, and other entities to assess the risk of providing credit, loans, or rental agreements to an individual.

Why it should be done: Credit checks play a crucial role in various financial transactions and decisions. They help assess risk, determine eligibility for credit or services, and provide valuable information to make informed decisions related to lending, renting, and other financial transactions

PAN Verification

What it is: PAN (Permanent Account Number) card verification is the process of authenticating the details associated with an individual's PAN card. PAN is a unique 10-character alphanumeric identifier issued by the Income Tax Department in India.

Why it should be done: It's important to note that PAN card verification contributes to maintaining the integrity of financial systems and ensures that individuals and entities provide accurate and verifiable information in various financial and legal transactions.

Drug Test Screening

What it is: Drug test screening is a process used to detect the presence of drugs or their metabolites in a person's body, typically through the analysis of biological samples such as urine, blood, saliva, or hair.

Why it should be done: Drug test screening is conducted to promote safety, comply with regulations, deter drug use, and address specific concerns in various settings. The reasons for conducting drug tests may vary based on legal, safety, and health considerations relevant to the specific context in which the screening is implemented.

Passport Verification

What it is: Passport verification is the process of confirming the authenticity and validity of an individual's passport. This verification is typically conducted by immigration authorities, government agencies, employers, or other entities to ensure that the passport presented is genuine, legally obtained, and belongs to the person presenting it.

Why it should be done: Passport verification is a crucial process for ensuring national security, border control, identity confirmation, legal compliance, and various other aspects related to international travel and immigration. It plays a vital role in safeguarding countries against potential risks and threats associated with unauthorized movement across borders.

Police Verification

What it is: Police verification is the process of conducting background checks on individuals by law enforcement agencies to verify their criminal record, address, and other relevant details. This verification is often required in various situations for security and safety reasons.

Why it should be done: Police verification is an essential tool in maintaining public safety, preventing crime, and making informed decisions in various situations where individuals are entrusted with responsibilities or given access to certain privileges. It helps authorities assess the background of individuals, identify potential risks, and ensure the safety and security of the community.

Driving Licenses Verification

What it is: Driving license verification is the process of confirming the authenticity and validity of an individual's driver's license. This verification is typically carried out by authorities, employers, or other entities to ensure that individuals possess a legally obtained and valid license to operate a motor vehicle.

Why it should be done: Driving license verification is essential for promoting road safety, ensuring legal compliance, preventing fraud, and maintaining the integrity of transportation systems. It plays a crucial role in various contexts, including employment, insurance, law enforcement, and overall public safety.

Voter Id Verification

What it is: Voter ID verification refers to the process of authenticating the identity of a voter using their Voter ID card, also known as the Electors Photo Identity Card (EPIC). This verification is crucial in the electoral process and is typically done during voter registration, polling, and other election-related activities.

Why it should be done: Here are some reasons why Voter ID verification is important because of Ensuring the Right to Vote, Maintaining Electoral Integrity, Preventing Multiple Registrations, Addressing Voter Discrepancies, Citizen Identification etc.

Tenant Verification

What it is: Tenant verification is the process of conducting background checks on individuals seeking to rent or lease a property. This process helps landlords, property managers, and real estate agencies assess the suitability of potential tenants before allowing them to occupy a rented space.

Why it should be done: Tenant verification involves checking references, conducting credit checks, verifying employment and income, and looking into rental history. The specific components of tenant verification may vary, but the overall goal is to make informed decisions that benefit both the landlord and the tenant.

Physical Address Verification

What it is: Physical address verification is the process of confirming the accuracy and legitimacy of a person's or entity's declared residential or business address. This verification is often conducted by various organizations, including financial institutions, government agencies, employers, and service providers physicaly.

Why it should be done: Physical address verification is a crucial step in various processes to prevent fraud, comply with regulations, improve service delivery, and make informed decisions. It contributes to the overall efficiency, security, and reliability of transactions and interactions across different sectors.

Step 1

Register yourself and our sales team contact you.

Step 2

Select the Checks as you need.

Step 3

Discuss the Financials with the Account Manager

Step 4

Initiate check. Our teams get working

Step 5

Receive the results in your Inbox

Step 1

Register yourself and our sales team contact you.

Step 2

Select the Checks as you need.

Step 3

Select the number of employees to be verified

Step 4

Register with Our API.

Step 5

Receive the verified records

Stay one step ahead.

Be the first to hear about tips, tricks and data-driven best practices for HR professionals.